Update, January 2021: This 2014 guide is still basically true, although TFSA limits continue to increase. I’ve updated a couple of the funds I referenced in this article to newer, even easier to use ones. Happy investing!

Tomorrow, Canadians will get an additional $5500 of TFSA contribution room. Most of us won’t do anything with it. Most people that do do anything will put the money into a cash savings account that, after inflation, loses money. Only 5% will put the money where it’s probably best kept: ETFs. The rest of the country is treating their Tax-Free Savings Accounts like, well, savings accounts.

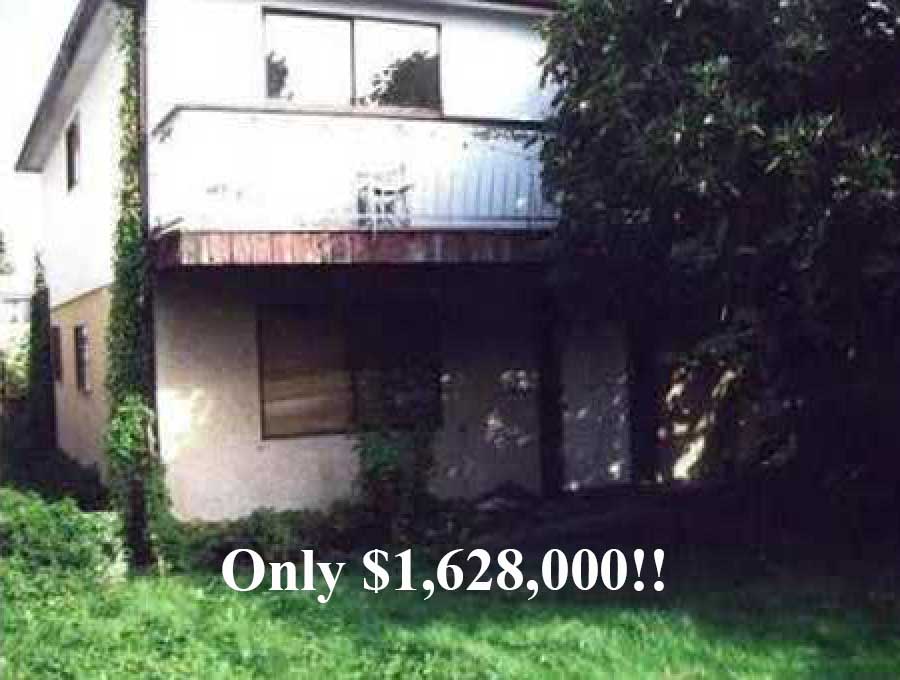

Many people in Vancouver’s tech community are privileged enough to accumulate sufficient savings to consider investing, but not enough to consider buying a $1 million crack shack. As a result, I often talk to folks who are curious about investing, but are too intimidated to start. While some of the intimidation comes from stories of investments gone wrong and echoes of 2008, I think even worse is the incomprehensible fog of investing terms.

In order to be technically accurate when talking about investing, you often need to use words like funds, instruments, and equities, when it’s really all just different kinds of shit you can buy. Next thing you know, you’re reading conflicting articles pitching you on how to get implausible returns on your investment. “No no, the way to do it is to invest exclusively in high-omega stock derivative option instruments with elevated beta carotene.” Historically, people had the option of just ignoring investing and retiring on their company pension. If that’s your plan for 2040 though, you’re gonna have a bad time.

Now, I am by no means a financial advisor. I make apps for a living, so take my financial advice in that context. If you are retiring soon, have a lot of money, are in debt, or just have the luxury of doing so, I’d encourage you to consult a fee-based accredited financial advisor that does not make their living selling high-fee mutual funds. That said, most people don’t have enough understanding of this stuff to even make sense of the crap on banks’ websites, and it’s not good for our future.

To retire reasonably, we have until our 60s to save more than a million dollars. Thankfully, in Canada, we have two useful kinds of accounts we can use to help save for retirement: TFSAs and RRSPs. People usually think these two programs are very different because of the names, but in practice they’re quite similar: they’re ways that you can register your retirement investments so you get tax benefits. Young people often benefit more from TFSAs, and people later in their careers often benefit more from RRSPs. If you’re lucky, you can afford to fund both. When you open an account at a bank or a stock brokerage, you can tell them to register it as a TFSA or RRSP, and you’re good to go. The question is, what kind of investments do you want in there?

The savings account is also cursed

While 1% interest is technically better than keeping your cash in a garbage bag in the closet, “high interest” savings accounts don’t compare well to the 7-10% return you would expect on the stock market, or even the 2% rate of inflation. No matter how you look at it, savings accounts are a bad fit for retirement funds. Retirement funds need long term growth, but don’t care much about short term fluctuations - which has the stock market written all over it.

Investing directly on the stock market is intimidating, so banks offer an alternative: actively managed mutual funds. These are easy-to-use programs where you can pay a bank a bunch of money to take even more of your money and play with it on the stock market. The bank’s highly-paid fund managers will try and make the fund’s growth graph go up and to the right faster than other funds. If they succeed, they’ll get bonuses and charge even higher fees. If they fail, the fund will be discontinued and a new fund will replace it, ensuring all of the pages in the bank’s full-colour brochure show funds whose graphs go up and to the right. It’s pretty great.

Looking to avoid mutual funds’ high fees, some investors take matters into their own hands. Statistically, this goes even more poorly. If you think some mutual fund managers make questionable decisions, wait until you see the average amateur stock picker. First, they’ll pick some stocks that seem cool but whose prices are dictated by large institutional investors that they have little way to predict. Then, they will suffer ruin at the hands of their own brain.

You see, our minds are really good at finding patterns, so when they see a stock that’s gone up a lot, they’ll want to buy more. When they see one that’s gone down, they’ll want to sell it. These behaviours together are known as “buy high, sell low”, which is literally the worst possible investment strategy. For the privilege, they’ll pay fees on each transaction. Those sadsack savings accounts start to look less horrible when your cousin’s blind faith in Blackberry stock and terrible market timing gradually ruins him.

Thankfully, it’s not all bad. There is an easy way to beat the returns of the mutual funds, your cousin’s Blackberry portfolio, and the savings account: just be average. Believe it or not, if your investments grow at the average pace of the stock market, you will do better than most investors when you take into account fees and expenses. Better yet, doing this is very simple: buy one of everything.

John Bogle first noted this way back in 1951, penning his senior thesis, “Mutual Funds can make no claims to superiority over the Market Averages.” After 20 years of refining his ability to title things, in 1974 he founded The Vanguard Group to sell the first index fund: a fund that simply bought every stock in the Fortune 500 list of most valuable stocks in America. At the time, Vanguard was widely mocked. It was considered “Un-American” to settle for simply average returns. What fool would settle for the consistent, reliable compound growth of the entire free market?

40 years later, Vanguard manages $3 trillion of index funds. They have widely popularized them, making efficient, sensible investment accessible to anybody. They’re also owned by the owners of their funds, in some ways like a credit union. Transcending the idea of simply and reliably providing an average return, index funds have since been found to actually outperform many of their more invasively managed competitors in practice. Many banks even offer index funds nowadays.

Don’t be squeamish

If you’re an adult Canadian, you’ll have tens of thousands of dollars in TFSA contribution room. If you haven’t been putting it to good use, but are intimidated by investing it, I encourage you to pick a very simple index fund investment strategy and stick to it. The site Canadian Couch Potato has some good info and example portfolios for this kind of investing.

My preferred way to buy index funds is to buy them online on the stock market. You buy a kind of stock called an ETF, or an exchange-traded fund. ETFs are just like other stocks in that they have a ticker symbol and you can buy or sell them any time, but they’re composed of hundreds of other stocks or bonds. A balanced investment portfolio can be as simple as putting your money in three or four ETFs.

If you really do want to keep things dead simple, you can just do like I do and use WealthSimple, a low cost online stock brokerage that lets you buy ETFs for free, and some Vanguard ETFs to build an almost absurdly simple low-cost investment account:

- Go to WealthSimple or a similar online brokerage, and open a TFSA.

- Fund that account using your bank’s online bill payment function.

- Use the money in your trading account to buy Vanguard ETFs. This can be as simple as putting 100% of the funds into stock symbol VGRO, a very broad long term growth-oriented index fund. Bam.

It can be as simple as that. Don’t panic sell when the markets go down, keep funding your account every three months until your TFSA is maxed, and you’re doing better than the vast majority of people. At that point, you might even decide to just let it ride, knowing that over the long term, you’re enjoying compound growth. If the idea of buying a stock is too much for you, then you can get even simpler and use a WealthSimple Managed account to do what I describe above on your behalf.

Or maybe, if you’re anything like me, a small initial experiment will motivate deeper understanding. You’ll go deeper down the rabbit hole, start reading bizarre real estate doomer blogs, and build mildly elaborate systems for the care and feeding of your retirement funds. You’ll read about rebalancing, diversification, bond funds, and central banks. Next thing you know, you’re subjecting the audience of your tech blog to your insane ramblings about Canadian index investing.

You know, the sky’s the limit.